- The Venture Canyon

- Posts

- Lifeway Foods: is Sheer Value Enough?

Lifeway Foods: is Sheer Value Enough?

We recommend buying $LWAY as we have conviction a huge quarter is upcoming

Why I like Lifeway Foods ($LWAY)

|

other than their kefir products ;), pitch above pretty much sums up everything I wrote here in a more presentable way

Price: $12.53

Market Cap: $185.95 Million

ROIC: 20.48%

Lifeway Foods, Inc. manufactures and markets probiotic-based products both in the United States and internationally. Its main product is drinkable kefir, a cultured dairy beverage available in a variety of organic and non-organic options, flavors, and formats. The company also produces European-style soft cheeses, creams, and other dairy items. Its product lineup includes ProBugs, a range of kefir products designed for children, drinkable yogurt, as well as freshly made butter and sour cream. Lifeway markets these products under the brand names Lifeway, Glenoaks Farms, and Fresh Made, in addition to private label offerings for clients, primarily distributed through a direct sales team, brokers, and distributors. Founded in 1986, Lifeway Foods, Inc. is headquartered in Morton Grove, Illinois.

The stock has dropped from all-time highs of $27.31 in May before sinking due to missed earnings on the bottom line and insider selling. I don’t think the missed earnings are a big deal as their SG&A increased by almost two million dollars way out of trend from recent quarters and I see this as hopefully a one-time thing. CEO Julie Smolyansky sold 540k worth of stock which brought a red flag to investors, I think this is a risk as she might know something we don’t but also knowing that this is a family business and her late father used to run it before his passing in 2002, in which Julie became the youngest female CEO of a publicly traded company at age 27. The top three shareholders still own 56% of the company which I think is a great sight to see.

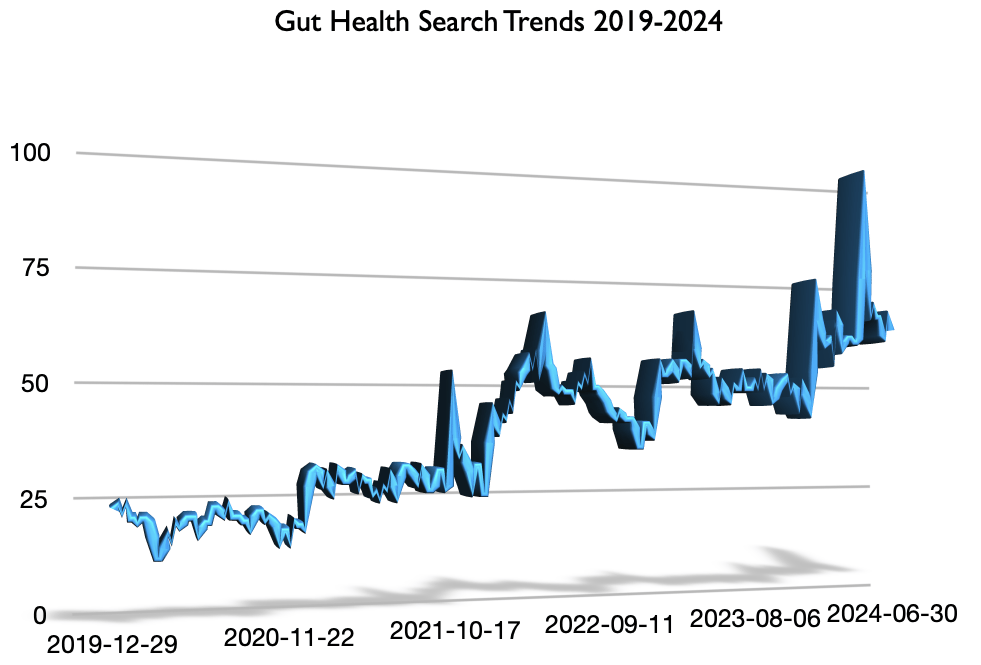

Lifeway's main product is their Kefir drink, this drink is skyrocketing the firm and in popularity overall due to its health benefits and Lifeway is early to the trend and still has benefits to reap. The Kefir market size is currently 2.85 billion with a CAGR of 6.4% but this isn’t a bet on the growing TAM of the market, this is a bet on how Kefir is strategizing to take advantage of the growing market. The largest Kefir market is Europe, where Lifeway has their products in over 100 stores and growing as people start to become more and more aware of their health, Lifeway has positioned itself to gain market share as they have recently started to put health claims on their products such as “supports immunity”. Lactose intolerant people are also looking for substitutes and kefir is popular among them. As a kid in Gen Z who watched COVID-19 happen, I started to see more and more people become health conscious especially Generation Z, who have made it a trend to limit processed foods. I think this growing health consciousness gives Lifeway an opportunity to add to their topline.

Kefir Market

Major Players: Danone, Chobani, Yoplait, Oikos, Lifeway

Fastest Growing Market: Europe

2023 Lifeway sales: $160.1 M

“Primarily driven by higher volumes of our flagship Lifeway-branded drinkable kefir,”- Julie Smolyansky

Global market projections for 2024 – 2029:

Market CAGR= 6.40%

Thoughts: $LWAY revenues will outperform market CAGR in ’24 and ’25

What's driving the Kefir Market?

There are a couple of market drivers, but I think only one matters;

Growing Health Consciousness of Consumers

After COVID, I saw many people around me start to become more health conscious and watch what they put into their bodies, and with the promotion of it all over social media, I don’t see it stopping anytime soon. A study done by the FIC shows that 80% of millennials consider health benefits when selecting foods compared to 64% of baby boomers. People are starting to watch their gut health and kefir and other products in Lifeway’s suite offer several health benefits which will be discussed in the next slide, I think these benefits combined with people starting to become more aware are shifting consumer preferences.

Nutritional Benefits

Kefir, such as Lifeway Kefir, is a cost-effective choice for nourishing the microbiome and supporting gut health and immunity. It offers a higher probiotic and CFU count with 12 live and active probiotic cultures and 25-30 billion CFUs, compared to yogurt, which typically has only 2–6 live and active cultures and around 6 billion CFUs on average.

Protein and Vitamin Content: Lifeway Kefir provides 10 grams of high-quality protein per 8-ounce serving, compared to most non-Greek commercial yogurts that offer only 4-6 grams of protein per 6-ounce serving. Kefir’s extended fermentation process also enhances its content of B vitamins, vitamin K, folic acid, calcium, and amino acids.

Lactose Content: Despite not being strained, Lifeway kefir is up to 99% lactose-free. In contrast, while many people with lactose intolerance can tolerate Greek yogurt, other commercial yogurts often have higher lactose levels that may not be well tolerated.

Digestibility: Lifeway Kefir’s unique fermentation process lowers its lactose content as beneficial probiotic cultures consume most of the milk sugar (lactose). This makes kefir easier to digest, even for many individuals who typically struggle with lactose intolerance

A study by BMC Medicine suggests that probiotics and daily Kefir show promise in improving the gut health of ICE patients

Kefir has many probiotics that influence digestion, weight management, and mental health, making it a more potent source of probiotics than yogurt

Overall, As food gets more and more processed nowadays, the marketing has switched from treating the illnesses caused by this food to preventing them, Kefir products offer a quick ready-to-drink beverage that is more functional and has fewer calories than other yogurt-like products promoted as healthy, and I don’t think the market has realized this shift in consumer preference yet.

Recent Earnings (Q1 2024)

Lifeway just reported their 4th quarter in a row of breaking company records for net sales with a top line of $44.6 million and net income of $2.4 million, which is shabby but I think it is an easy fix as mentioned earlier. They also reported an EPS of $0.17 cents. One key thing that I think CEO Julie Smolyansky mentioned was that “Consumers continue to face well-documented macro headwinds, including inflation and high interest rates.” I don’t want to tailor this to be a macro pitch but with rates being so high right now this is also a bet on the consumer sector as inflation is slowly but surely heading towards that 2% target and 1-2 cuts seem likely this year, I see consumer spending increasing in the back half of the year. She also mentioned that 2023 was a year where they saw growth each quarter and that will lead to YoY laps getting more difficult but gross profit margins increased 410 basis points compared to q1 2023. I think this is a big thing as I see Lifeway as a company that definitely needs some polishing up on their financials and increasing their gross profit margin like that is a major start and I think signals more to come. Management has seen margins remain a top priority for them ever since they have seen demand increase, they are making their supply chain more efficient and also a top priority which has improved their margins and will even more down the road, which I don’t think the market is pricing in.

Catalyst: Marketing Strategy

Strategic Partnerships: Lifeway’s products were showcased at Kourtney Kardashian’s Camp Poosh, leveraging her 223 million Instagram followers for widespread reach.

Targeted Events: Focus on marketing at popular wellness events like yoga gatherings and music festivals, tapping into health-conscious audiences.

Future Growth Potential: Lifeway’s niche in the wellness category and strategic marketing is poised to drive significant future growth as health consciousness continues to rise.

“We had a great brand experience at Coachella last month”- CEO, Julie Smolyansky

Coachella draws a yearly attendance of nearly 650,000, making it the country's largest music festival. This relationship needs nurturing as it is a huge marketing opportunity for Lifeway and so far, so good as Smolyansky has stated how much the influencers loved their products.

Sheer Value

Even though Lifeway has sold off, it still possesses a 20.48% ROIC, higher than other industry players such as Danone (8.38%), General Mills (13.82%), and Hain Celestial (4.17%). I don’t think investors are processing how much value Lifeway is generating along with the efficiency of their capital.

A disciplined investment plan in growth capital, cost reduction, facility improvements, and financial efficiency has helped Lifeway boost its ROIC from 2.58% in 2022 to 19.92% in 2023, and now 20.48%.

EV/EBIT (NTM)

Lifeway Foods-8.4x

General Mills-13.5x

Danone-13.3x

Hain Celestial-13.8x

EV/EBITDA (NTM)

Lifeway Foods-6.9x

General Mills-11.5x

Danone-10.2x

Hain Celestial-9.1x

Despite complete outperformance, Lifeway is still trading below industry multiples, I expect a correction in the back half of 2024 after earnings digestion

Valuation

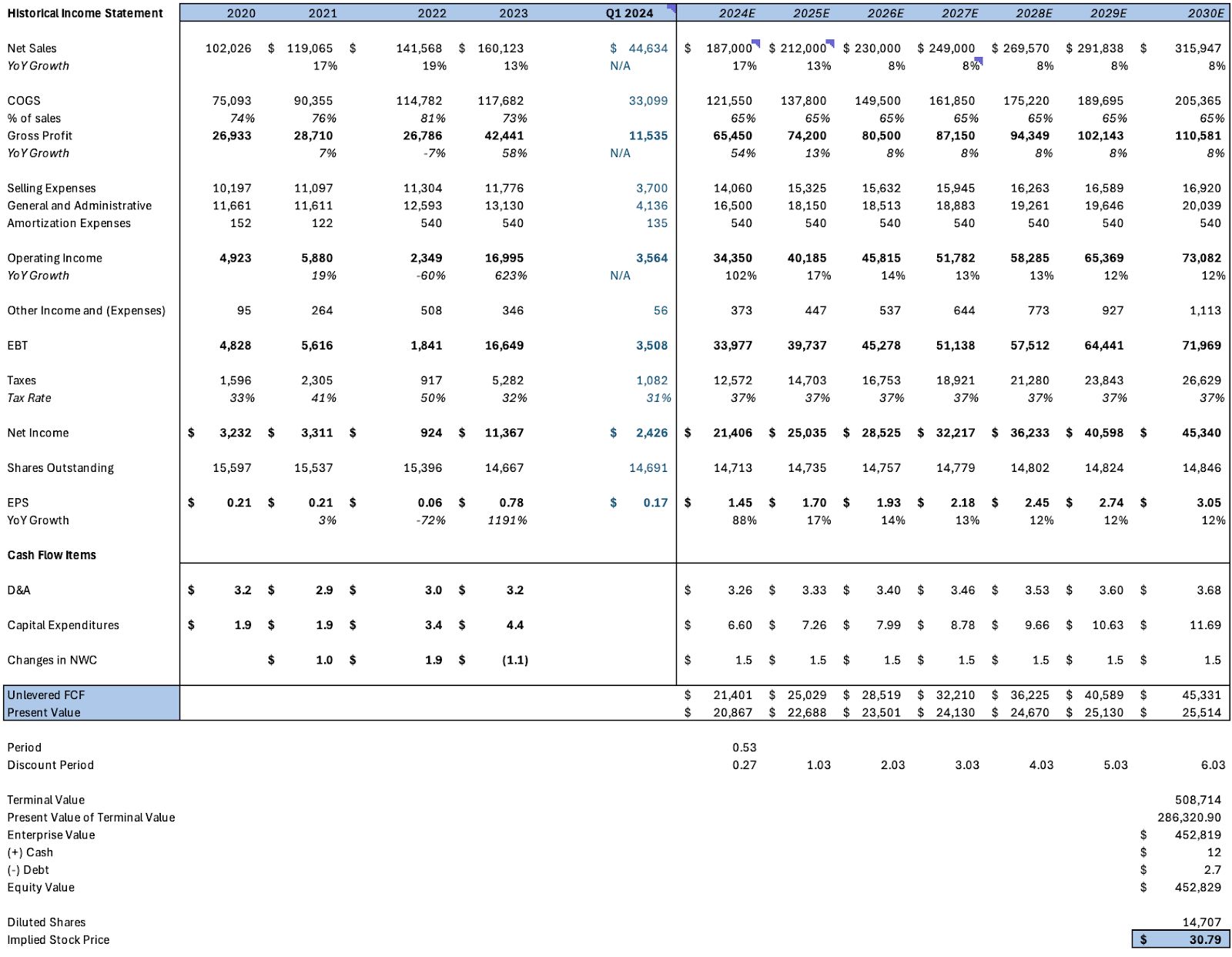

In my model I have Lifeway continuing their trend of growth from a down year in 2023 and growing 17% compared to street expectations of;

Bear 12% with $179.6, Base 15% with $184.6, and Bull 18% with $189600

I don’t think the market is currently pricing in any more great quarters as investors have started to sell off. I took slightly bullish assumptions in my model and ended up with a share price of $30.79. Lifeway is currently trading around $12-13 and given my target price I see around a bullish 130%ish upside.

Activist/ Acquisition Play

Lifeway Foods is a prime acquisition target in its niche market, particularly for food and beverage giant Danone, which acquired a stake in the mid-1990s and now holds 23.49% ownership. Danone's recent earnings call highlighted a solid start to the year in Europe, with YoY revenues growing by 2.8%, and Europe being Kefir's largest market.

Despite no clear signs of an acquisition, Danone's recent purchase of a niche foods tube feeding business called Functional Formalities on May 1st indicates potential interest. Lifeway's assortment of products and the already-held ownership make it a beneficial acquisition for Danone.

Some people argue that if Danone were a buyer they would have bought when Lifeway was trading at lower prices but I think they still want to see Lifeway expand their product assortment

Danone also sold two of their organic yogurt brands earlier this year, Wallaby and Horizon Organics, some might take this as a sign that aren’t interested in the space but these two brands were lagging the crowd with lower sales and profitability than the group average. Lifeway isn't a lagging brand, it's a leading one

Jefferies analysts praised the move saying that “the brands were diluting margins possibly by tens of basis points.”

Overall I think this just makes room for a potential move down the line.

Lifeway was already blasted in 2023 by wealth management firm, Kanen Wealth Management, which held a 4.1% stake in the company, claiming that the board and CEO are mismanaging the business and not acting in shareholders' best interests. They argued that the company's stock was undervalued and called for a sale of Lifeway, estimating a potential share price between $15 and $20, when shares were trading at $7. Lifeway could benefit from an activist who would better help govern the company.

Investment Risks

Although the barrier of entry to Lifeway’s main industry is pretty low I think the biggest risk is dissident Shareholders: The widow of Lifeway Foods' founder, Ludmila Smolyansky, and her son, Edward Smolyansky, are attempting to oust CEO Julie Smolyansky, leading to potential leadership upheaval. They have nominated themselves and five other candidates for the board.

Legal Disputes: Ongoing lawsuits between the company and the Smolyanskys include accusations of breaches of prior agreements and contractual obligations, adding to governance uncertainty.

Family Conflict: Julie Smolyansky remains CEO after a family conflict over control, with Danone supporting her. This internal strife could impact company stability and decision-making.

This has led to Edward and Ludmilla setting up a competing brand, Pure Culture Organics, which also sells Kefir.

A lawsuit was filed by Lifeway claiming they stole secret information but has since been dropped.

This article sums it up pretty well,

Revenue Dependency

Revenue growth in 2024 and on will rely on increasing case volumes as there were no price increases in 2023. The company does not provide guidance, making future revenue and profitability dependent on market expansion rather than inflationary pressures.

Lifeway’s revenue in the first quarter was mostly composed of their kefir sales, which were $36 million of the $44 million in sales they generated. Their next most-sold item was their cheese, which accounted for $3.5 million of sales.

Their two biggest customers accounted for 49% of their net sales in the first quarter. This could be a problem if one of these customers starts to taper off.

Milk Prices

Gross margins are highly dependent on milk prices, which fluctuated significantly in recent years. While Q1 margins are expected to be strong due to lower milk prices, any future increase in milk costs could adversely affect margins Milk prices jumped a bit during the first quarter which showed in Lifeway's profit margin and prices have only been higher since then Lifeway Foods is a company that manufactures and markets probiotic-based products, particularly their flagship product, drinkable kefir. The company reached all-time highs earlier this year but investors have sold off after a missed earnings report coupled with a string of insider selling, but investors are currently too negative on the business.

Conclusion

Lifeway is trading at a cheap price right now and trades at a discount to some of its peers in the food products industry. I hold a $30 price target based on a DCF valuation, with assumptions just in line with bullish estimates from Wall Street analysts.

Although I do not see any clear-cut catalyst except earnings, I do think that their marketing strategy and capital deployment is something that investors should do more work on as it has led me to believe that they can tap markets that will eventually lead to them reaping more upside.

Reply